Landscape of Pension Funds in GCC region

Posted on 03/16/2019

This content is by Marmore Mena Intelligence.

The primary objective of a pension system is to ensure that the elderly have a decent standard of living post retirement. However, the different interpretations of this primary objective muddle the pool. The first interpretation is that the pension system should ensure only a basic standard of living. The main focus is on the “adequacy” of the pension benefit. Given the relatively wealthy status of the individuals in the GCC region, incorporating such an objective cannot be achieved without reasonably compromising on the living standards, which would prove to be a huge fiscal burden and a politically motivated decision.

The second interpretation is that the pension system should ensure a reasonable standard of living post retirement relative to the position before retirement. This means the pension system plays the role of insurance. Replacement rate would be in focus in this scenario. While GCC region is currently following this second interpretation, they are too high compared to global standards bringing into question the sustainability of these funds.

Globally, pension funds are one of the most popular instruments that sovereign governments and large institutional investors have used to fund the retirement benefits of their workforce. In the last two decades owing to burgeoning fiscal deficits and increasing inflation, Governments have been reviewing their schemes and benefits, prompting a shift from defined benefit model to defined contribution model. However, with respect to the development of pension funds, GCC region is still in nascent stages and continues to be an outlier.

Generous Government benefits, tight-knit family structures and religious obligations meant that the nationals in the region have little to worry about pensions. GCC countries still follow the defined benefit model while globally the trend has shifted to defined contribution model. Their income replacement rate after retirement is quite high and pension eligibility starts relatively earlier which further aggravates the current situation.

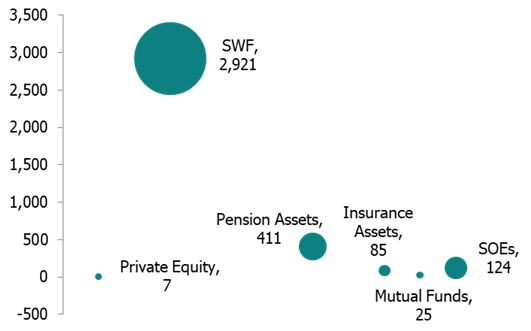

Landscape of GCC Institutional Investors, 2016 (USD bn)

Source: Marmore Research

Pension fund assets have the second largest amount of Assets under Management (AuM) in the region, making them one of the key institutional investors in the region. Although higher oil prices for most part of the decade boosted government’s ability to fund probable shortages in future, oil price slump since 2014 due to shale, negative outlook towards fossil fuels and slowing growth across most of the prominent economies warranted pension funds to relook into their obligations, retirement age and in few instances recapitalisation. The oil prices slump in the past few years led to pension funds being underfunded relative to the benefits that are being promised.

GCC pension systems are only partially funded with most retirement benefits paid out with the help of excess contributions from the employees rather than income derived from pension assets. This position may not be sustainable unless structural reforms in the pension system are introduced. Responsibility for managing the assets should gradually shift away from the government towards the individuals, and thereby to private pension fund managers. It would also lead to a gradual shift in pension systems from defined benefit plans to defined contribution plans, wherein the liability of institutions ends with pension contribution and the management of the same would fall under the scope of respective employees. There is a need to draw long-term investment policies and asset allocation should be modified to meet the liabilities. Currently there is no One-Size-Fits-All rule to define the proper level of basic pension or replacement rate. GCC region needs to take into account a multitude of factors to find the right mix.

Marmore’s report, GCC Institutional Investors III – Pension Funds, is a detailed study focusing on the development and evolution of pension funds in the GCC region, which also covers asset composition, pension eligibility, key growth drivers, key challenges and provides policy recommendations. This report would provide an in-depth understanding about the landscape of pension funds in GCC.