The Value of Research: Skill, Capacity, and Opportunity

Posted on 02/19/2019

This article is sponsored by S&P Dow Jones Indices.

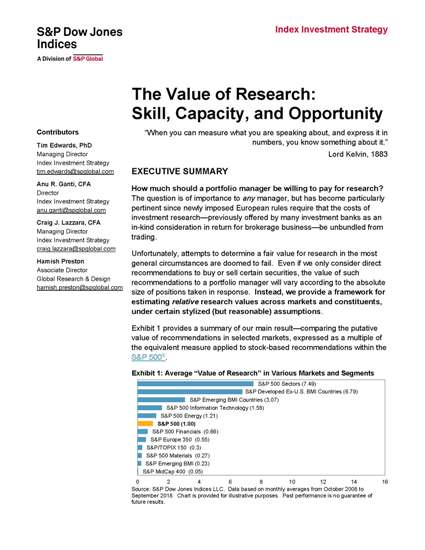

How much should a portfolio manager be willing to pay for research? The question is of importance to any manager, but has become particularly pertinent since newly imposed European rules require that the costs of investment research—previously offered by many investment banks as an in-kind consideration in return for brokerage business—be unbundled from trading.

Unfortunately, attempts to determine a fair value for research in the most general circumstances are doomed to fail. Even if we only consider direct recommendations to buy or sell certain securities, the value of such recommendations to a portfolio manager will vary according to the absolute size of positions taken in response. Instead, we provide a framework for estimating relative research values across markets and constituents, under certain stylized (but reasonable) assumptions.

REPORT: The Value of Research: Skill, Capacity, and Opportunity