Falling Peso and Oil Prices Plague Mexico’s Prospects

Posted on 12/13/2014

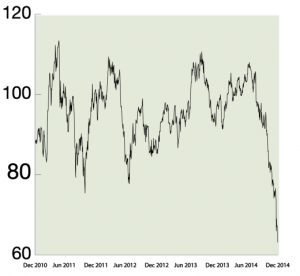

Source: Thomson Retuers, EIA The falling global price of oil is having a material impact on fiscal budgets with regard to fossil fuel-reliant economies. Being a key oil exporter to the United States, Mexico is on the brink of opening foreign investment in the energy sector, planning auctions in 2015. Meanwhile, large-scale energy companies, plush […]

- Blackrock

- Chevron

- Energy

- energy reform

- Mexico

- oil prices

- oil production

- Oil Revenues Stabilization Fund of Mexico

- OPEC

- PEMEX