LEAGUE TABLES: Goldman Sachs Takes the Iron Throne for 2016

Posted on 01/17/2017

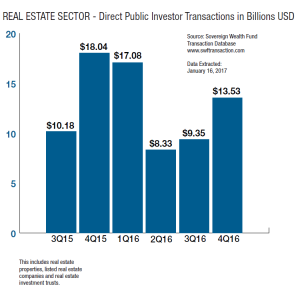

The Sovereign Wealth Fund Institute (SWFI), through its proprietary database, tracks direct transactions by sovereign wealth funds, pensions and other public funds. The database has a bias toward equity, real estate and infrastructure transactions and a much lower emphasis on bond deals. Combining all public investors, for calendar year 2016, transactions amounted to US$ 205.25 […]

- Bank of America Merrill Lynch

- CBRE

- China

- Citigroup

- Clifford Chance

- Credit Suisse

- Deals

- Europe

- Goldman Sachs

- HSBC