MODI EFFECT: SWFs and Pensions Intensify Direct Investments in India

Posted on 06/13/2016

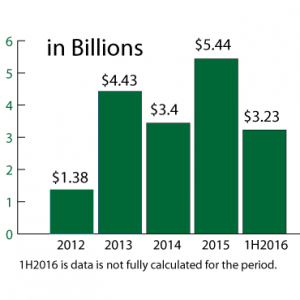

Narendra Modi was sworn in as Prime Minister of India on May 26, 2014. Somewhat stronger private property rights, slightly-loosened regulation and friendlier foreign investment laws have increased the flows of foreign institutional investor capital. Since 2013, direct investments by sovereign funds and public pensions into India have ramped up, according to time-series data from […]

- Abu Dhabi Investment Authority

- cdpq

- Deals

- India

- Infrastructure

- IPO

- Modi

- NIIF

- Norway

- Sovereign Wealth Fund Transaction Database