New Zealand Superannuation Fund Releases Annual Report

Posted on 10/17/2013

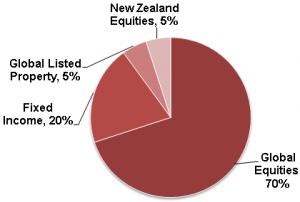

The NZ$ 23 billion (US$ 19.26 billion) New Zealand Superannuation Fund (Fund) released its 2012/2013 annual report today, and there are a few highlights. For starters, the management team under CEO Adrian Orr achieved a record return for the Fund of 25.83%. Since the New Zealand Superannuation Fund began investing in September of 2003 it […]