Press Release – SWFI Survey of Public Funds Shows Strong Interest in Smart Beta

Posted on 10/07/2014

FOR IMMEDIATE RELEASE

- Includes survey of 72 public institutions, including 16 SWFs, with over US$ 2.9 trillion in public investor capital represented.

- Interviews with 8 asset owners from 8 different countries with combined AUM of over US$ 250 billion.

- Additional research provided by four leading practitioner firms: Northern Trust Asset Management, State Street Global Advisors, Robeco and WisdomTree.

Smart Beta Infographic

SEATTLE, Wash. – 7 October 2014 – A survey of public investors conducted by the Sovereign Wealth Fund Institute indicates that adoption of smart beta strategies is growing globally.

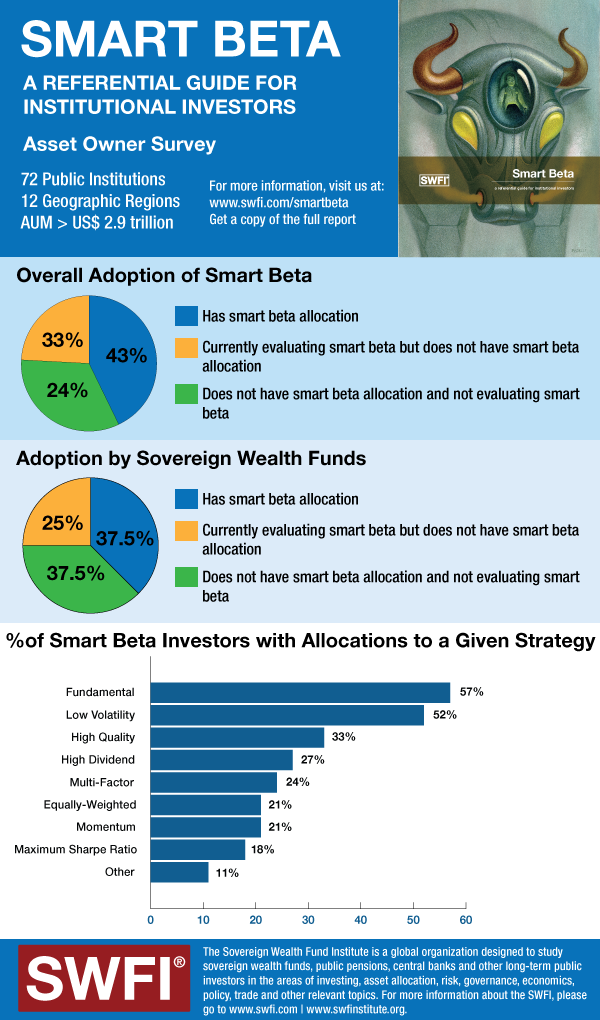

Among the public institutions surveyed, 67% claim to already have smart beta allocations or are currently in the evaluation process. Of the sovereign wealth funds in the sample, 37% say that they have allocations, while another 25% say that they are currently evaluating a smart beta strategy.

In terms of popularity, fundamental and low volatility strategies outpace other approaches, being employed by 57% and 52% of those funds with smart beta investments, respectively.

The full survey results will appear in SWFI’s newly published Smart Beta: A Referential Guide for Institutional Investors. This report, sponsored by Northern Trust, Robeco, State Street Global Advisors and WisdomTree, marks the beginning of a new series of SWFI publications that compile research on specific asset classes to aid institutions in making investment decisions.

Smart Beta: A Referential Guide for Institutional Investors consists of a discussion of smart beta (what it is, why it works, advantages and disadvantages), a Q&A with 8 different public and private institutional investors and a survey of 72 public funds – including 16 sovereign wealth funds – asking about their perceptions and implementation of these strategies. A collection of research papers provided by the sponsors is interspersed throughout the guidebook to offer technical insight into the mechanics of smart beta and factor investing.

“The spread of smart beta strategies among public investors seems to be snowballing worldwide, especially among the larger and more sophisticated institutions like sovereign wealth funds,” said Jess Delaney, Research Director at SWFI. “Although the US and Europe are leading the charge, the results of our survey suggest that smart beta is making inroads with funds in the Middle East and Asia as well, and perhaps to a greater extent than previously reported by other financial media outlets.”

“SWFI is very excited about launching this new line of referential guides for institutional investors, beginning with the current issue on smart beta,” said Michael Maduell, CEO of SWFI. “We are honored to have had the opportunity to partner with some of the most prominent firms in the smart beta realm for this inaugural issue.”

About SWFI

The Sovereign Wealth Fund Institute is a global organization designed to study sovereign wealth funds, public pensions, central banks and other long-term public investors in the areas of investing, asset allocation, risk, governance, economics, policy, trade and other relevant topics. For more information about the SWFI, please go to www.swfi.com | www.swfinstitute.org.

—————————– END —————————–

You can obtain a copy of the research and additional smart beta white papers here: swfi.com/smartbeta

For more information contact:

Vincent Berretta

Director of Marketing, SWFI

+1 (702) 768 – 0703

vberretta@swfinstitute.org