Real Estate: A Powerful Sovereign Wealth Fund Investment Trend

Posted on 10/06/2014

In September this year, Norway’s sovereign wealth fund, in one giant swoop paid US$ 1.5 billion for minority interests in two Boston properties and the former Citigroup Center in Manhattan. The amount of capital floating en route for core real estate is astonishing, more and more sovereign funds are allocating toward properties. In fact, for public institutional investors, real estate is one of the top sectors of direct investment.

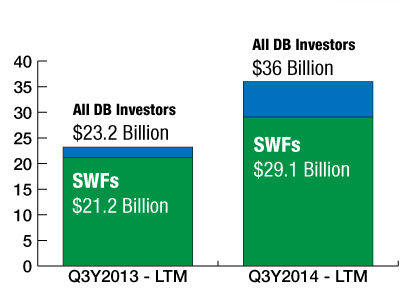

The Growth of Direct Sovereign Wealth Fund Transactions

Source: Sovereign Wealth Fund Transaction Database – Data in Billion USD

Real Estate Figures: Sovereign Wealth Fund Transaction Database Data

According to the Sovereign Wealth Fund Transaction Database, comparing the period of September 30, 2014 going back 12 months, total direct public investor transactions in real estate were US$ 36 billion compared to US$ 23.22 billion for transactions starting at September 30, 2013 going back 12 months. Limiting the database universe to sovereign wealth fund direct transactions exclusively, by comparing figures in similar periods, the figures are US$ 29.11 billion for 2014 versus US$ 21.15 billion for 2013. Currently, with regard to the Sovereign Wealth Fund Transaction Database, sovereign wealth funds make up the majority of transactions, thus the number of total public institutional investor transactions in properties should be much higher.

Looming 2014 Sovereign Wealth Fund Trends in Real Estate

-

1. More Joint Ventures, Finding Local Partners

2. Tax Issues, Large Minority Interests

3. Other Key Cities, Besides Gateway Cities

4. Luxury and Hotel Properties

5. Indian Real Estate (Modi)

A resilient second wave of Asian institutional capital is bypassing London, flooding bits of continental Europe. In addition, Gulf sovereign wealth funds such as the Kuwait Investment Authority, Qatar Investment Authority and the Abu Dhabi Investment Authority have been active investors in continental Europe. This year, Constellation Hotel Holdings, controlled by the Qatar Investment Authority (QIA), agreed to pay €330 million for the InterContinental Paris – Le Grand and allocated €60 million for future hotel renovations. This can also be said of the large Canadian pension investors like the CPPIB and OMERS.

Another Bubble?

Sovereign wealth funds and pensions are at risk of a supply drought in core properties. With higher real estate fund commitments and deployment amounts, an unprecedented level of demand is being created by large public institutional investors. This trend could be exacerbated if U.S. defined contribution retirement accounts make the push into real estate assets.

- Boston

- Metlife

- New York

- Norway

- real assets

- Real Estate

- Sovereign Wealth Fund Transaction Database

- Sovereign Wealth Funds

- Towers