Sovereign Wealth Fund Direct Transactions Highest YTD Since 2008

Posted on 08/06/2014

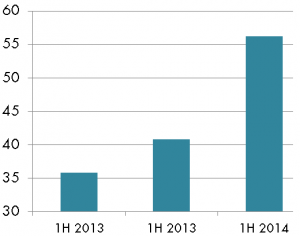

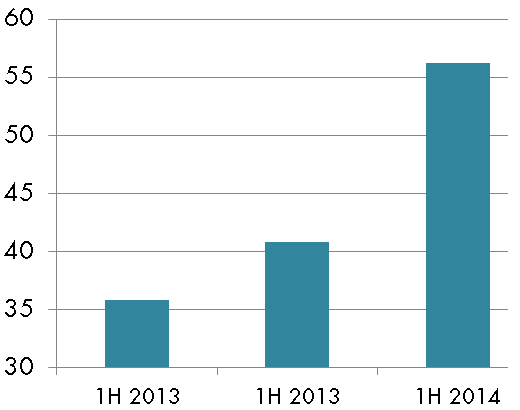

Direct Sovereign Wealth Fund Transactions – Billions USD

Source: Sovereign Wealth Fund Transaction Database – Extracted August 5, 2014

Direct deals and transactions by global sovereign wealth funds touched US$ 50.02 billion in the first half of 2014. This is a 23.1% increase in transactions comparing it to the first half of 2013 (US$ 40.64 billion). The highest first half on record of direct sovereign wealth fund transactions was the first half of 2008 (US$ 51.05 billion), a significant portion of that amount was attributable to the bank bailouts.

Singapore is the lead acquiring nation for sovereign wealth fund direct transactions with US$ 21.21 billion for the first half of 2014. This is followed by the United Arab Emirates and China. In 2014, Temasek Holdings opened a New York office.

Big Deal: Temasek-AS Watson Transaction

Singapore’s Temasek Holdings US$ 5.7 billion purchase of a 25% stake in AS Watson Holdings is the biggest sovereign wealth fund deal in the first half of 2014. Another notable deal is Rotterdam-based Vitol SA and the Abu Dhabi Investment Council move to acquire Shell’s Geelong oil refinery and local service station network in Australia.

Hot Sector, Financials Wins

Financials is the most targeted sector for direct sovereign wealth fund transactions with US$ 12.9 billion recorded in the first half of 2014. This compares to US$ 9.03 billion from the first half of 2013. Consumer discretionary and consumer staples follow with US$ 9.64 billion and US$ 7.37 billion, respectively.

Some lead financial advisors in terms of transaction amounts for the first half of 2014 for all public investor transactions (sovereign wealth funds and public funds) include: Goldman Sachs, Credit Suisse, DBS, HSBC, Bank of America Merrill Lynch, and Morgan Stanley.

- Abu Dhabi Investment Authority

- Credit Suisse

- DBS

- Deals

- Goldman Sachs

- Morgan Stanley

- Singapore

- Sovereign Wealth Fund

- Temasek Holdings