SWFI First Read, December 7, 2015

Posted on 12/06/2015

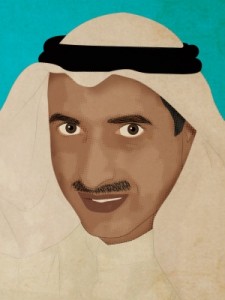

Kuwait Investment Authority Signed Articles of Agreement for AIIB On December 4th, the Kuwait Investment Authority (KIA) signed the articles of agreement of the Asian Infrastructure Investment Bank (AIIB). The Managing Director of the KIA Bader Mohammad Al-Sa’ad signed the agreement on behalf of the Kuwaiti government. The signing occurred at the Chinese Ministry of […]