SWFI Subscription is a professional subscription-based investor research platform.

World's Most Popular and Trusted Source on Institutional Investors and Global Capital

Explore The Possibilities

Profiles

All ProfilesGet free daily publication of news around the institutional space delivered to your inbox

SWF Members¹

News

All NewsSWFI Subscription and Offerings

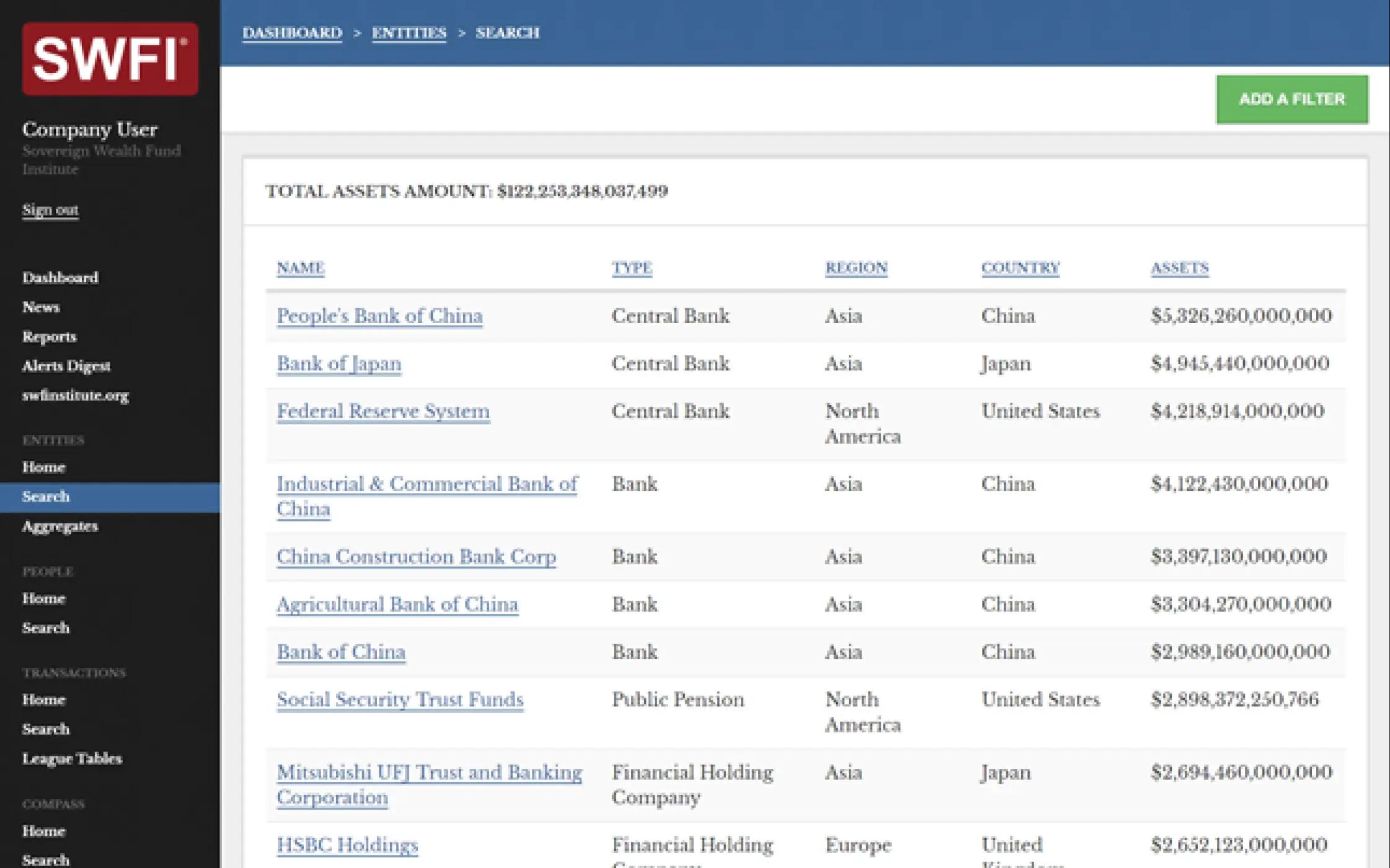

Get access to deals, key executives, strategy notes, mandates, asset allocation data, news, and profiles. Interested in events - learn more about the SWFI Membership.

ServicesSWFI Membership & Events

Get access to deals, key executives, strategy notes, mandates, asset allocation data, news, and profiles. Interested in events - learn more about the SWFI Membership.

Services MembershipTake a demo and get a guided walkthrough with a platform expert.

Book a DemoTransactions

All TransactionsRFPs

All RFPsMembers

1. This list is not complete and may include past members.