2 Reasons Why China Recently Dumped Treasuries

Posted on 02/21/2014

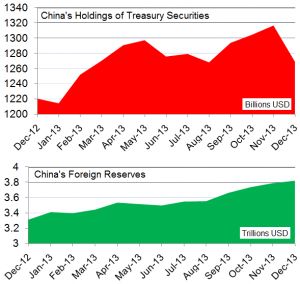

December Treasury International Capital (TIC) data was semi-calamitous for the United States Treasury due to China’s year-end retraction of Treasuries. Maintaining quantitative easing and stepping in, the Federal Reserve became the largest financier of the U.S. government’s deficit in 2013. In total, the U.S. government issued a net US$ 759 billion in Treasury securities to […]