AIMCo Opens Up Shop in London

Posted on 01/31/2014

The Alberta Investment Management Corporation (AIMCo), one of Canada’s largest public asset owners, has opened an office in London. Increasingly, Canadian public investors are setting up offices globally to be closer to their current and potential private investments. The evolutionary trend of public asset owners opening up offices to be near financial centers is an ongoing occurrence in this decade. To name a few institutional investors that have set up operations in London include: Kuwait Investment Authority, Abu Dhabi Investment Authority, GIC Private Limited, CPPIB, Korea Investment Corporation, and the Brunei Investment Agency.

AIMCo seeks to augment exposure to investments in private equity, real estate and infrastructure in Europe. AIMCo, along with other Canadian pensions, feel that going direct can reduce the cost of capital on investing in private deals. AIMCo has around US$ 8 billion invested in the U.K. and continental Europe in both public and private markets.

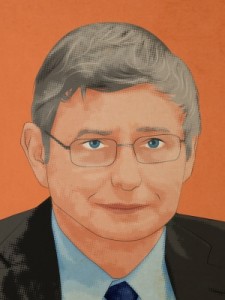

“Alberta Investment Management Corporation is a globally diversified investor with holdings in more than 50 countries and all asset classes,” states Leo de Bever in a press release, chief executive officer. “Our decision to establish a modest presence in London is driven by the efficiencies it affords us in our quest to deliver the best risk-adjusted rate of return on behalf of our Clients.”