Sovereign Funds Embrace Direct Real Asset Deals

Posted on 08/01/2013

The thirst for real assets has not abated for sovereign wealth funds. Clear statistics derived from the Sovereign Wealth Fund Institute’s transaction database sheds light on the impact sovereign wealth funds have in acquiring investments in the real asset economy. The Sovereign Wealth Fund Transaction Database has recorded over $600 billion worth of direct transactions made by sovereign funds. The increase in direct transactions reveals that large institutional investors like sovereign wealth funds have built up sufficient internal capacity to go out on their own. For the time being, there is no slowdown in sovereign wealth funds investing in real assets.

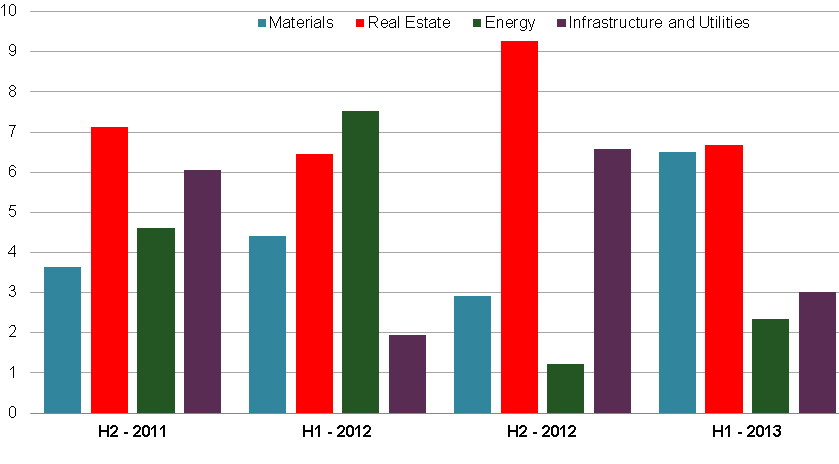

European core real estate is a chief driver for direct sovereign wealth fund transaction growth. $9.26 billion in direct sovereign wealth fund transactions were recorded in institutional real estate for the last half of 2012. In comparison, to the last half of 2011, $7.13 billion worth of direct transactions were recorded. Let’s not let Europe hog all the glory, Norway’s Government Pension Fund Global (GPFG) purchased 49.9% of five U.S. office properties through a joint venture with TIAA-CREF – properties were valued at $1.2 billion. A secondary cause of the increase is the proliferation of sovereign wealth funds being engaged in developmental real estate – particularly with Gulf funds. Hudson Yards and CityCenterDC, two monstrously large U.S. developmental projects are examples of major deals.

Direct Sovereign Wealth Fund Transactions – Real Asset Sector – Click to Enlarge

Billions in USD

Source: Sovereign Wealth Fund Transaction Database, August 2013

In the majority of cases, acquiring infrastructure without intermediaries takes longer than buying property. A smidge after the first quarter of 2013, Tawreed Investments Limited, a sovereign wealth enterprise of the Abu Dhabi Investment Authority, was part of a consortium including Industry Funds Management, Australian Super and QSuper to buy the lease on Port Botany and Port Kembla. Combined, the two port deals equaled AUD 5.07 billion.

For the time being, there is no slowdown in sovereign wealth funds investing in real assets.

Energy and Materials

Spiking in the first semester of 2012, energy-related transactions amounted to $7.53 billion. Singapore’s Temasek Holdings invested hundreds of millions in KrisEnergy, an upstream oil and gas company focusing on Southeast Asia. KrisEnergy started as a portfolio company backed by First Reserve Corporation. Shifting to material-related transactions, in the first half of 2013, it totaled $6.5 billion. By late June 2013, Norway’s sovereign wealth fund owned a little more than 3 percent of BASF SE, the world’s largest chemical company. Another German chemical company in which the wealth fund owns a growing stake is The Linde Group.

Keywords: Norway Government Pension Fund Global, Qatar Investment Authority.