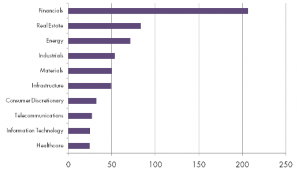

If Size Matters, Financial Sector Most Attractive for Sovereign Wealth Funds Between 2007 to 2013

Posted on 04/16/2014

In the past decade, sovereign wealth funds produced major strides when it comes to direct investing. From the start of 2007, till the end of 2013, the top three sectors for direct sovereign wealth fund investment were financials, real estate and energy. The 2007 banking bailouts are still major contributors to the financial sector aggregate […]