First Quarter 2013 – Resilient Start for Direct SWF Transactions

Posted on 05/20/2013

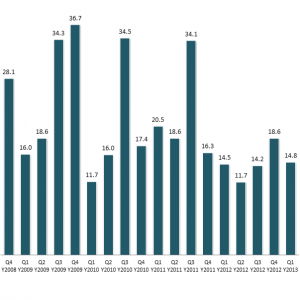

First quarter data of 2013 from the Sovereign Wealth Fund Transaction Database (SWFTD) has been tabulated. During the first quarter of 2013, direct sovereign fund transactions totaled US$ 14.8 billion. This is an incremental increase of 2.06% compared to the first quarter of 2012. As 2013 progresses, the first quarter number should experience a positive revision. Sovereign wealth funds entered a high number of direct market transactions stemming from the fourth quarter of 2012 till the end of the first quarter of 2013.

This illustrates sovereign funds played a role in the increased price growth in global public equity markets.

Total Direct Sovereign Wealth Fund Investment Activity Per Quarter Click on image to enlarge

Source: Sovereign Wealth Fund Transaction Database – Latest database statistics of 5/19/2013

Direct investments in U.K. public equities increased from the fourth quarter of 2012. There continues to be stable investment in U.S. equities, directly from sovereign funds over the past six quarters.

Core real estate is a popular direct investment choice for sovereign funds. Some notable first quarter 2013 deals include Norway’s Government Pension Fund Global (GPFG) buying a 49.9% stake in five office properties in the United States through a joint venture with TIAA-CREFF. The real assets were valued at US$ 1.2 billion. The Abu Dhabi Investment Authority purchased an office at 90 boulevard Pasteur owned by Credit Agricole for € 250 million.

Direct Investments by Notable Sectors – Billions USD

| Period | Financials | Real Estate and Infrastructure | Information Technology |

|---|---|---|---|

| Q3 Y2012 | 1.09 | 5.16 | 1.68 |

| Q4 Y2012 | 4.68 | 8.92 | 0.77 |

| Q1 Y2013 | 1.63 | 4.50 | 0.72 |

Source: Sovereign Wealth Fund Transaction Database – Latest database statistics of 5/19/2013

Data for the second quarter of 2013 presents an increase in sovereign fund participation in private equity buyouts and initial public offerings.

Keywords: Norway Government Pension Fund Global.