Survey Reveals Global Asset Owners See Trade Wars as Biggest Tail Risk

Posted on 03/07/2018

According to the quarterly SWFI Global Asset Owner Survey conducted in February 2018, large sovereign funds and pensions take the observation that trade wars and increased protectionism is currently the biggest tail risk. This is a shift from the stock market bubble as the biggest tail risk, which was revealed in December 2017. U.S. President Donald Trump announced tariffs on steel and aluminum as part of his “America First” strategy in which, he aims to get better trade agreements between countries to improve trade deficits between major trading partners. Critics contend this could create a retaliatory trade war, including Trump’s own National Economic Council Director Gary Cohn, who resigned on March 6, 2018. Proponents of the tariffs argue that the U.S. entered into trade deals far less favorable to U.S. companies in the past to help out other countries grow and become more stable.

According to the Office of U.S. Trade Representative, “U.S. goods and services trade with the EU totaled nearly $1.1 trillion in 2016. Exports totaled $501 billion; Imports totaled $592 billion. The U.S. goods and services trade deficit with the EU was $92 billion in 2016.

U.S. goods and services trade with China totaled an estimated $648.5 billion in 2016. Exports were $169.8 billion; imports were $478.8 billion. The U.S. goods and services trade deficit with China was $385 billion in 2016.”

The quarterly survey targets sovereign funds, pensions, endowments, superannuation funds, foundations, government funds and other asset owners. Totaled estimated survey sample size was over US$ 1.2 trillion of assets under management.

Download

Only available for participants and subscribers.

Here are some key findings:

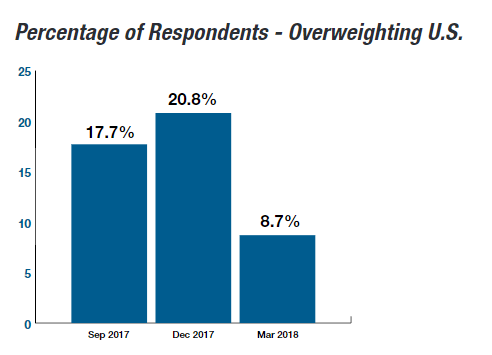

The majority of respondents see long equities as the most crowded trade – specifically in Long Russell or S&P Index. Long U.S. technology equities were a close second.

Now that U.S. tax reform is baked in, the majority of respondents view Treasury bonds yields as the biggest driver of equity prices in the next 6 months.

Holding Steady – 45.5% of respondents plan to increase allocation to Europe ex-U.K. – a percentage and trend that has held steady in the last two quarterly surveys.

25% of respondents plan to underweight cash, meaning investors are keen to deploy capital

According to Michael Maduell, president of SWFI, “It is too early to properly wargame the effects of President Trump’s action on tariff policy, but it has created a level of anxiety among the global institutional investor class.”

More About the Global Asset Owner Survey

This is SWFI’s third quarterly survey for asset owners. To participate in the next quarterly survey, CONTACT research@swfinstitute.org.

SWFI intentionally excludes 3rd party asset and fund managers in this survey. As an independent authority on asset owners, SWFI feels that it is uniquely qualified and strategy agnostic to show a true “lay of the land”.